Time:2022-07-22 Source:Original website Popularity:1086

Oceancarriers have widely predicted a y/y decline in spot rates in the second half.Even so, liner operators Maersk, Hapag-Lloyd and Zim (NYSE: ZIM) all expect 2022 results to be better than in record-setting2021.

The reason: Both spotand contract rates were up y/y in the first half and y/y declines in spot ratesin the second half should be offset by much higher contract rates.

However, there are atleast four looming risks to container shipping bottom lines. If businessconditions are much worse than expected, 2022 might only be the second bestyear in the industry’s history.

The first risk: Spotrates, while pulling back, have stayed at relatively high levels and notcollapsed. But as Vincent Clerc, CEO of Maersk’s ocean division, said on aconference call last year, “Given the extreme levels [in] the short-term rates,the correction toward a more normal level could be quite rapid.”

Second, carrier costsare rising. On Wednesday, the world’s largest carrier, MSC, said a general rateincrease for its India-U.S. service was needed on July 15 because “freightrates are at levels that are no longer sufficient given current costs.”

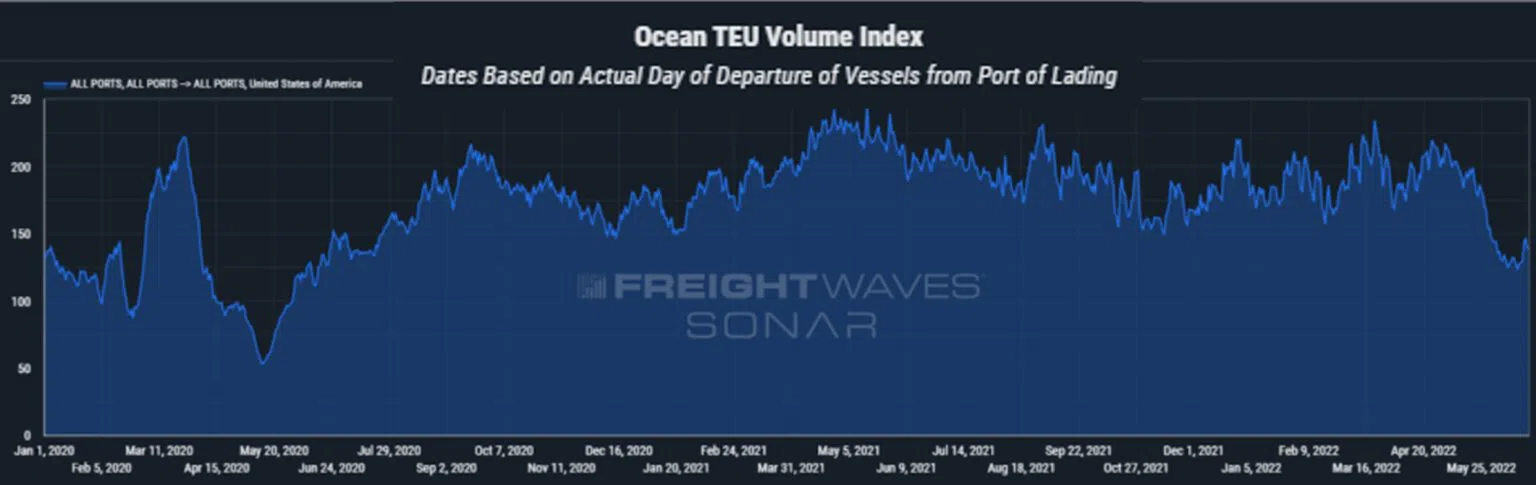

Third,cargo volumes might fall more sharply than expected. It’s too soon to know howholiday bookings and port congestion will play out, but FreightWaves SONAR’sindex of bookings shows a steep decline for U.S.-destined cargo scheduled to depart in May and early June.

And fourth,contracts used by carriers to protect against spot and volume downside may notprovide full protection.

Lars Jensen, CEOof Vespucci Maritime, warned in an online post on Thursday: “Unless the markettightens quickly in the next week or two, we will begin to see shippers pushingback on contracts in terms of renegotiations and/or shifting volumes to thespot market and not delivering the full contracted volumes to the carriers.”